Reference

Optimize test data management with unsupervised learning. Our AI solution identifies representative vehicle configurations, maximizing test coverage and reducing manual efforts.

Reference

Use machine learning to predict rework in vehicle production. Reduce error costs and optimize production processes through targeted analyses.

Success Story Ritter Energie

A chatbot simplifies customer service by automating common queries and providing quick, efficient responses. This saves companies time and resources.

Reference

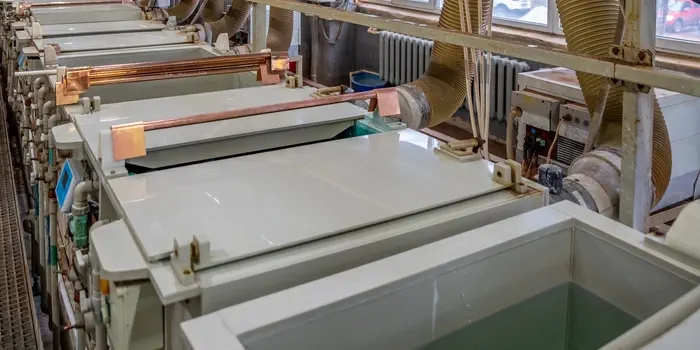

Accurately count small components on large carriers. Our AI solution automatically tallies the parts, reducing errors and increasing production precision.

Reference

Prevent customer churn with AI-based tariff change prevention. Leverage intelligent analytics to optimize tariffs and enhance customer retention.

#rethinkcompliance Blog

Authorities and financial institutions (FIs) are highly aware of the challenge of detecting financial crime. Modern criminals are using increasingly more complex structures and are acting across multiple financial institutions and jurisdictions. Parties, such as FIs, FIUs , and law enforcement, operating alone encounter challenges in the identification and tracing of suspicious behavior.

.jpg)